Exploring Industry-Specific Cyber Liability Needs for American Businesses

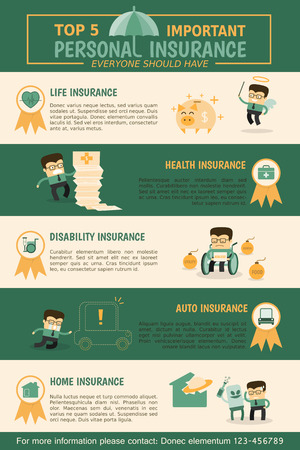

Understanding the Basics of Cyber Liability InsuranceCyber liability insurance has become an essential safeguard for American businesses of all sizes. In today’s digital world, companies face a growing number of…